Who We Are

Founded in 1988 over a small bookstore in downtown New York City, the D. E. Shaw group began with six employees and $28 million in capital and quickly became a pioneer in computational finance. In the early days of exposed pipes and extension cords, tripping on a cable could take out our whole trading system. Today, the firm has more than 3,000 people around the globe and an institutional-grade (and trip-proof) infrastructure, but we still value creativity, entrepreneurship, and the spirit of discovery.

The firm prizes a culture of collaboration across disciplines, geographies, and investment strategies. Experienced leadership and talented minds chart our course. Analytical rigor, an open exploration of ideas, and a relentless pursuit of excellence drive us forward.

Leadership

For us, seven

working together to make strategic decisions are

stronger than one.

Return to Executive Committee Members

Anne Dinning is a managing director of D. E. Shaw & Co., L.P. and Chair of the Executive Committee of D. E. Shaw & Co., L.P. and D. E. Shaw & Co., L.L.C., in which capacity she jointly supervises the D. E. Shaw group’s worldwide businesses. Dr. Dinning has oversight responsibility for the firm’s Corporate Development department and DESCOvery, its venture studio. She joined the D. E. Shaw group in 1990 as a quantitative researcher in the firm’s Equity Arbitrage trading unit. From 1995 until 1999, Dr. Dinning was the managing director responsible for the D. E. Shaw group’s worldwide asset management activities. Over the subsequent two decades, she was instrumental in the development of a number of the firm’s investment capabilities, as well as the formation of D. E. Shaw Investment Management, L.L.C. (“DESIM”), which manages benchmark-relative equity and multi-asset class investment strategies. For much of that period, Dr. Dinning also served as a member of the D. E. Shaw group’s Risk Committee, which is responsible for firmwide risk management and capital allocation. She received her Ph.D. in computer science from New York University’s Courant Institute of Mathematical Sciences.

Dr. Dinning was the 2006 recipient of the Industry Leadership Award presented by 100 Women in Hedge Funds, an organization committed to the professional advancement of women in the alternative investment industry, and was appointed to the Asset Managers’ Committee of the President’s Working Group on Financial Markets in 2007. She is a member of the boards of directors of the Robin Hood Foundation, a philanthropy targeting poverty in New York City; Partners In Health, which helps provide medical care to patients in poor communities around the world; and Code.org, a non-profit organization dedicated to expanding access to computer science in schools and increasing participation by women and underrepresented minorities in that field. Dr. Dinning is also a member of the Visiting Committee of the Department of Electrical Engineering and Computer Science at the Massachusetts Institute of Technology.

Max Stone is a managing director of D. E. Shaw & Co., L.P. and, as a member of the Executive Committee of D. E. Shaw & Co., L.P. and D. E. Shaw & Co., L.L.C., jointly supervises the D. E. Shaw group’s worldwide businesses. Mr. Stone also serves as Chair of the D. E. Shaw group’s Risk Committee, which is responsible for firmwide risk management and capital allocation, and he has oversight responsibility for the activities of the firm’s Chief Risk Officer. He oversees the D. E. Shaw group’s Discretionary Macro trading unit, which he launched in 2004, as well as its Energy and Reinsurance investment units and Treasury department. In addition, Mr. Stone is a member of each of the Executive Committee and Investment Committee of D. E. Shaw Investment Management, L.L.C. (“DESIM”), in which capacities he jointly supervises DESIM and oversees the research and portfolio management activities it conducts for its benchmark-relative equity and multi-asset class investment strategies. After joining the D. E. Shaw group in 1992, he was involved with the evaluation and implementation of a number of firmwide structural and strategic initiatives and later oversaw the development and operation of several of the group’s investment strategies. Mr. Stone managed the D. E. Shaw group’s fixed income trading unit from its inception in 1994 until 1998, and was subsequently responsible for all of the group’s investment strategies. He graduated magna cum laude from Brown University in 1991 with a degree in psychology. Mr. Stone is a member of the board of directors of Partners In Health, which helps provide medical care to patients in poor communities around the world.

Eddie Fishman is a managing director of D. E. Shaw & Co., L.P. and a member of the Executive Committee of D. E. Shaw & Co., L.P. and D. E. Shaw & Co., L.L.C., in which capacity he jointly supervises the D. E. Shaw group’s worldwide businesses. Mr. Fishman is also a member of the Executive Committee of D. E. Shaw Investment Management, L.L.C. (“DESIM”), which manages benchmark-relative equity and multi-asset class investment strategies. He serves as the D. E. Shaw group’s Chief Operating Officer (“COO”) and has oversight responsibility for several of the firm’s functions—including back-office financial operations, human capital, and legal and compliance—as well as for the operations of the firm’s India offices. Mr. Fishman also jointly oversees the firm’s global trading and information technology platforms. Prior to his appointment as COO in 2010, he was a senior member of the D. E. Shaw group’s Investor Relations department. Before that, he had management responsibility for a multi-manager portfolio the firm once advised and shared responsibility for the operations of D. E. Shaw Research, LLC, which focuses on the early-stage development of technology-oriented ventures. Prior to joining the D. E. Shaw group in 1995, he served as an equity research analyst at the Spanish investment firm A.B. Asesores. Mr. Fishman graduated with honors from Princeton University with a degree in comparative literature. He holds the Chartered Financial Analyst® designation.

Alexis Halaby is a managing director of D. E. Shaw & Co., L.P. and a member of the Executive Committee of D. E. Shaw & Co., L.P. and D. E. Shaw & Co., L.L.C., in which capacity she jointly supervises the D. E. Shaw group’s worldwide businesses. Ms. Halaby is also a member of each of the Executive Committee and Investment Committee of D. E. Shaw Investment Management, L.L.C. (“DESIM”), in which capacities she jointly supervises DESIM and oversees the research and portfolio management activities it conducts for its benchmark-relative equity and multi-asset class investment strategies. She has managerial responsibility for the D. E. Shaw group’s Investor Relations department and oversees DESIM and the firm’s External Communications department. Ms. Halaby previously served as a rotating member of the D. E. Shaw group’s Risk Committee. She spent more than four years as a member of the D. E. Shaw group’s fixed income trading unit, where she traded G10 sovereign debt and interest rate derivatives and conducted investment research. Ms. Halaby joined the firm in 2003 as a member of the group’s Financial Operations department. She received her B.S. in biological sciences from Stanford University.

Edwin Jager is a managing director of D. E. Shaw & Co., L.P. and, as a member of the Executive Committee of D. E. Shaw & Co., L.P. and D. E. Shaw & Co., L.L.C., jointly supervises the D. E. Shaw group’s worldwide businesses. In addition, Mr. Jager is a member of the firm’s Risk Committee, which is responsible for firmwide risk management and capital allocation. He oversees the D. E. Shaw group’s Fundamental Equities, Asset-Backed Strategies, Convertible Securities, Corporate Credit, and Private Credit investment units, which collectively deploy capital across public and private equity and credit markets. Prior to joining the firm in 2011, Mr. Jager served as an equities analyst at Perry Capital, LLC. He began his career as an investment banking analyst at Morgan Stanley & Co. Inc. Mr. Jager is a magna cum laude graduate of Yale University, where he earned a dual degree, with honors, in ethics, politics, and economics and political science and was elected to Phi Beta Kappa. He received his J.D. from Stanford Law School and M.B.A. from the Stanford Graduate School of Business (“GSB”). Mr. Jager serves as a member of the Stanford Graduate School of Business Trust, which manages a portion of the GSB endowment. He also serves on the board of trustees of Saint Ann’s School.

Anoop Prasad is a managing director of D. E. Shaw & Co., L.P. and, as a member of the Executive Committee of D. E. Shaw & Co., L.P. and D. E. Shaw & Co., L.L.C., jointly oversees the D. E. Shaw group’s worldwide businesses. Dr. Prasad is also a member of the firm’s Risk Committee, which is responsible for firmwide risk management and capital allocation, and he jointly oversees the firm’s global trading and information technology platforms. In addition, he serves as Global Head of Systematic Equities, in which capacity he oversees the research, development, implementation, and trading of the firm’s alternative quantitative equity strategies. Dr. Prasad joined the D. E. Shaw group in 1997 after earning his master’s and doctoral degrees in theoretical physics from the California Institute of Technology. His graduate work focused on exotic states of matter such as superfluidity and superconductivity and involved the extensive application of computational methods. Dr. Prasad received his B.Sc. in physics from the University of Bombay in 1991. He is a member of the board of trustees of the Institute for Advanced Study in Princeton, NJ.

Adam Deaton is a managing director of D. E. Shaw & Co., L.P. and, as a member of the Executive Committee of D. E. Shaw & Co., L.P. and D. E. Shaw & Co., L.L.C., jointly oversees the D. E. Shaw group’s worldwide businesses. Mr. Deaton is also a member of the firm’s Risk Committee, which is responsible for firmwide risk management and capital allocation. In addition, he heads the firm’s Systematic Futures trading unit and oversees its Options trading unit. Since joining the D. E. Shaw group in 1998, Mr. Deaton has contributed to quantitative research and development with respect to every asset class systematically traded by the firm. He earned an S.M. in computer science from Harvard University and an A.B. in mathematics, with high honors, from Princeton University.

Founder

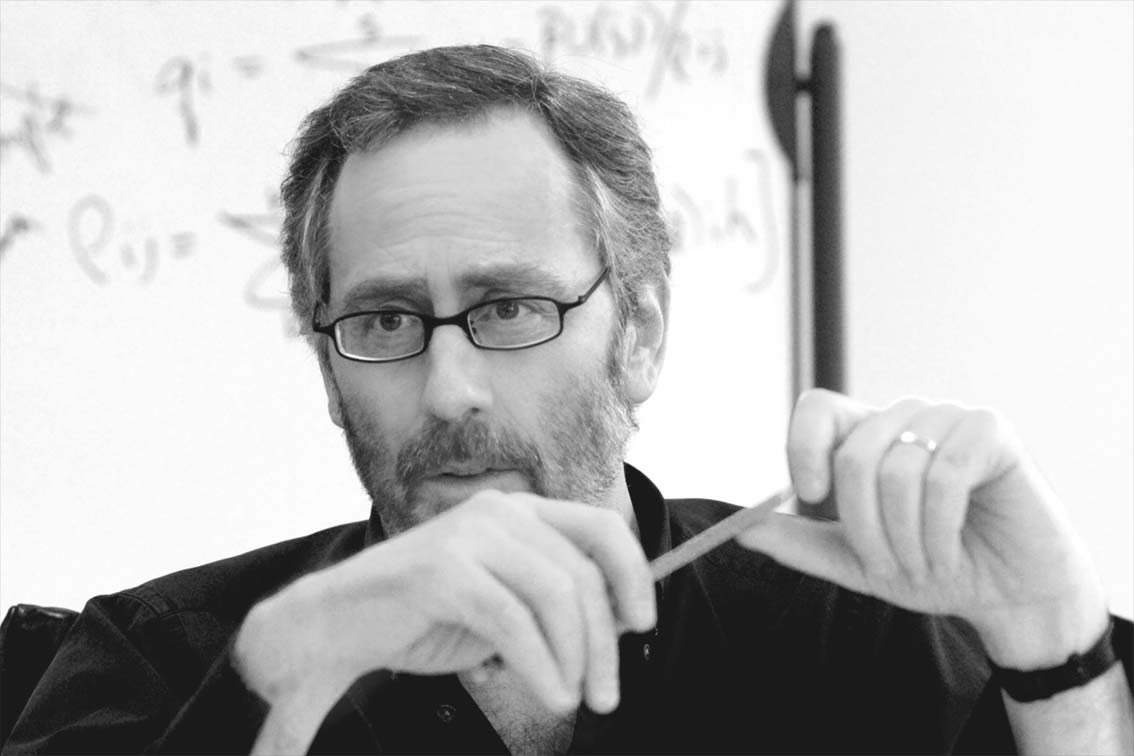

Our firm was founded in 1988

by David E. Shaw.

While Dr. Shaw remains involved in certain higher-level strategic decisions affecting the investment management businesses of the D. E. Shaw group, the firm’s day-to-day operations are overseen by the firm’s Executive Committee. The vast majority of his time is now devoted to his role as chief scientist of D. E. Shaw Research, LLC, in which capacity he leads an interdisciplinary research group in the field of computational biochemistry and personally engages in hands-on scientific research in that field. He also holds appointments as a Senior Research Fellow at the Center for Computational Biology and Bioinformatics at Columbia University and as an Adjunct Professor of Biochemistry and Molecular Biophysics at Columbia’s medical school.

Dr. Shaw received his Ph.D. from Stanford University in 1980 and served on the faculty of the Computer Science Department at Columbia University until 1986, when he left to pursue the emerging field of computational finance. He initiated his work on computational biochemistry in 2001, began building the scientific team at D. E. Shaw Research in 2002, and resumed his affiliation with Columbia in 2005.

Dr. Shaw was appointed to the President’s Council of Advisors on Science and Technology by President Clinton in 1994, and again by President Obama in 2009. He is a two-time winner of the ACM Gordon Bell Prize, and was elected to the American Academy of Arts and Sciences in 2007, to the National Academy of Engineering in 2012, and to the National Academy of Sciences in 2014.

Core Principles

At the firm’s foundation are five core principles that define our values and guide our decisions. These concepts are part of our DNA.

Hire and Cultivate Extraordinary People

Take the High Road

Set Unusually Ambitious Goals

Focus on the Firm as a Whole

Analyze Rigorously and Communicate Clearly

Our People

We spend time extensively searching the globe for talented individuals. We invest in those who are able to think creatively, who are relentlessly rational, and who put ego aside in the interest of getting things right. Then we empower them to do their best work in an environment where they are free to express the eclectic parts of their personality.

Our employees—who they are and the perspectives they bring—drive our creativity, productivity, and success.

Whether they came by way of academia, Silicon Valley, or an NGO, everyone has their own story of how they arrived here, and why they’ve stayed. Listen to their views to learn what it’s like to work at the D. E. Shaw group.

- 1 video

Making an Impact:

- 3 videos

Discovering the Firm:

- 3 videos

Work & Process:

- 4 videos

Culture & Colleagues:

- 1 video

Finding a Balance:

- 3 videos

Internship Program: